2023 tax forms mailed January 17.

Each year, you may or may not get a tax form from MIDFLORIDA depending on the amount of interest you have earned on your account, and/or paid for your mortgage, during the calendar year, and whether you received any miscellaneous income, such as prize money.

When will my tax forms be available?

2023 tax forms mailed January 17, 2024.

Tax forms will be available by January 31 but possibly sooner. We will update this page and post an announcement on our home page when they are available.

How do I set up direct deposit?

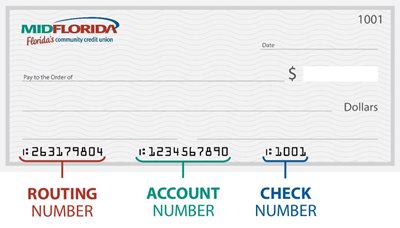

The IRS allows direct deposit as a convenient way to accept your tax return. Whether you file by yourself or hire a tax preparer, you’ll need to have your MIDFLORIDA Credit Union account and routing numbers handy to set up direct deposit for your tax refund. MIDFLORIDA's routing number is 263179804.

There are a couple of ways to find your full account number:

- In Free Online Banking

Click on the Accounts tab and select View / Edit Accounts. (Full account numbers are not available within Premier Online Banking.)

- In the Mobile App

Tap the Profile cogwheel and select My Information.

- On your checks

For checking accounts, you can use your MICR number. This can be found on the bottom of your MIDFLORIDA checks between the routing number and the check number. See example below.

Can I get my tax forms online?

Yes. All members who have enrolled in Free Online Banking have access to electronic tax forms. Simply log in to Free Online Banking and click the Tax Forms tab. Applicable tax forms that are available to you will appear in the drop-down menu. If you log in after tax forms are available for the prior year (generally in late January) and receive the message “No tax documents available,” then your situation did not cause a tax form to be generated for the prior year.

Note: 1099 MISC forms are not available online at this time, so if your situation generated a 1099 MISC, it will be mailed to you.

Where do I find tax forms in the app?

To find tax forms in the app, tap the cogwheel in the top right corner and open the Documents dropdown. Select "Tax Forms" to open a list of all forms available for electronic viewing.

Will my tax form be mailed?

Yes, all tax forms will be sent to the mailing address you have on file. If you have Online Banking then it will be viewable online as well.

How do I update my mailing address?

To update your mailing address, log in to Online Banking and click the Profile tab. Choose "Home Address" from the sidebar and you can update your mailing and physical address. In the app, this can be found by tapping the cogwheel in the top right corner and opening the My Information dropdown. Select "Address" to review and edit what you have on file.

Which forms will I get, and why?

A 1099 is used for sources of income other than salary and wages, and it’s important to note that not all 1099 forms are the same. While a 1099-INT form is used for reporting interest income, a 1099-MISC is used for just that…miscellaneous income.

These forms are generated for our members only if the following income criteria are met.

- 1099 INT- interest earned totaling $10 or more

- 1099 MISC – Prize winnings totaling $600 or more

- 1099R – For any retirement account distribution

- 1099SA - Health Savings Distribution

- 1098 – Mortgage interest paid totals $600 or more

- 1042S - Interest greater than $1 to foreign persons

- 5498 - IRA contributions

Will all members of my household receive the same forms?

Not necessarily. Tax forms are generated per individual, which means that not all members will receive one. For example, if you earned more than $10 in interest on your primary account, but your spouse has a separate account which earned less than $10 in interest, only you will receive a tax statement. Joint accounts will receive only one of each applicable form, mailed to the primary account holder.

How can I request a reprint of the tax form that was mailed to me?

You can request a reprint at any branch, or by calling our Help Desk at 863-688-3733 or toll free 866-913-3733. Note that we can only mail tax forms to an address on your account records.

What is included in the “Other” dollar amount in Box 10 of my 1098 form?

Depending on your personal circumstances, this amount may include a few different numbers, such as property taxes or late fees, but are totaled together. For filing purposes, if you need a more specific breakdown of the items that contribute to the amount in Box 10, please contact our Help Desk at 863-688-3733 or 866-913-3733.

Where’s my tax refund?

MIDFLORIDA processes all ACH deposits, like those from payrolls or tax returns, within one business day of receiving the electronic file. This means that while companies that prepare your taxes may request that your refund be processed, the money will only appear in your account once it is actually received by MIDFLORIDA (which could take some time).

A Note for Businesses

As a convenience for our business members, the interest paid on all business loans is reported to the IRS. The term “mortgage interest” is listed on the 1098 and includes any interest paid on a business loan for the prior year that totals $600 or more. This may include any real estate taxes if you had an escrow account with us.

The 1098 is issued to the Tax-Reported Owner of the account.