Overview

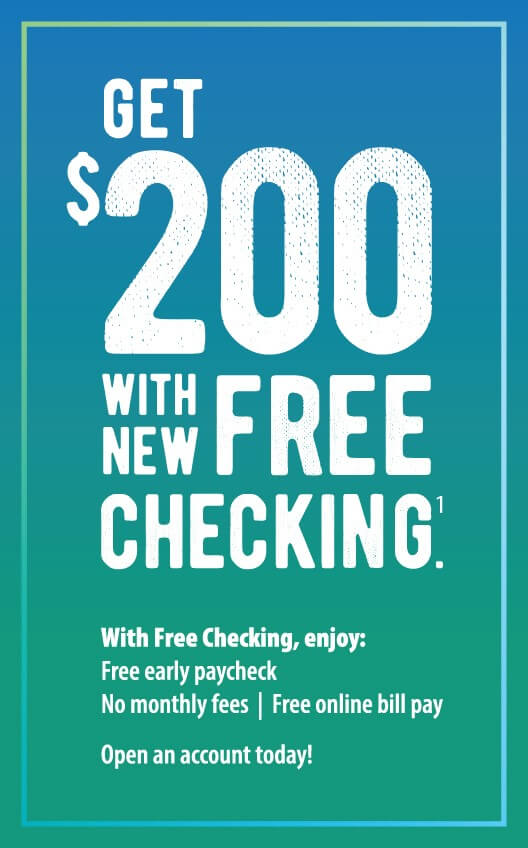

Are you ready for better checking?

MIDFLORIDA Credit Union offers all the big bank services with the personal attention that's missing from banking these days.

As a member, you are an owner in the credit union and that means our focus is on you - not shareholders. We pass along our savings to you through fewer fees, better rates and flexible banking options.

Compare MIDFLORIDA to the Big Banks