OVERVIEW

At a glance what you can get.

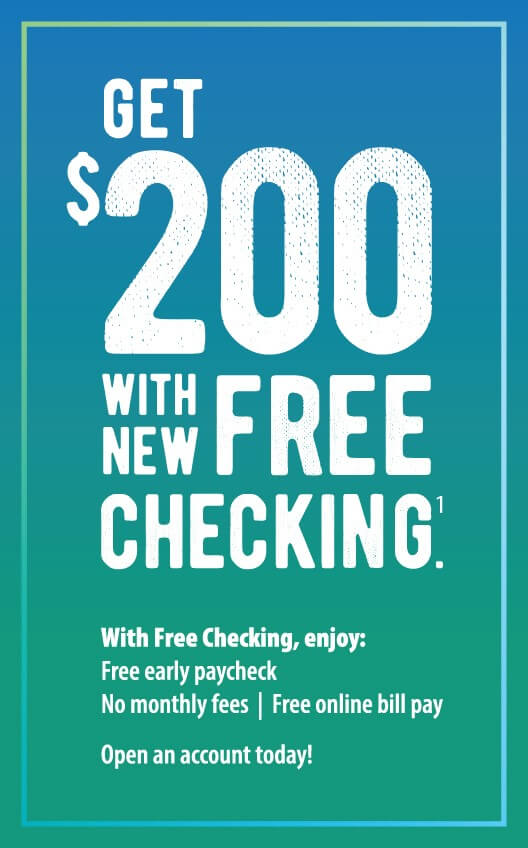

Want an economical, yet simple way to do your banking? With a Free Checking account, you’ll receive many cost-saving advantages, including no minimum balance to maintain and unlimited debit card use, without losing any convenient services or account accessibility.

Become a MIDFLORIDA Credit Union member and open a Free Checking account by applying online or visiting a branch.

Open an Account