Overview

The best account for short-term savings

Whether you're saving for a new car, a dream vacation or just setting up an emergency fund, MIDFLORIDA's High Five Savings account makes sure your money is put to work for you. You'll earn a rate that's top of market on certain balances, while keeping easy access to your cash. Available to open online only.

Save toward financial goals

Account Rates

| Tier |

Rate |

APY |

| Balances up to $2,000 |

4.89% |

5.00% |

| Balances over $2,000 |

0.01% |

5.00% to 0.01% |

Open an Account

How do blended rates work?

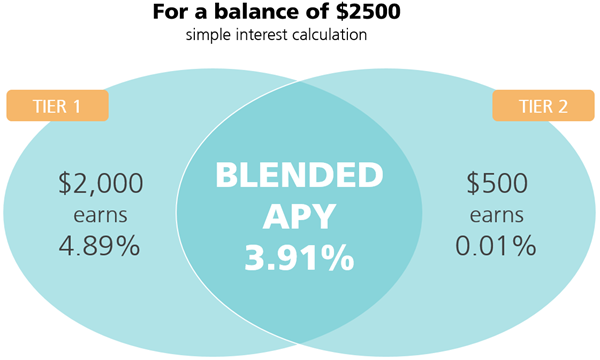

The High Five Savings account pays a different dividend rate on the amount of funds in each tier. Each dividend rate will apply only to the portion of the account balance within each tier and not the entire account balance. This is known as a blended APY.

The higher your balance, the lower the blended APY:

- For a $2,000 deposit, the APY = 5.00%

- For a $2,500 deposit, the blended APY = (2000*0.0489+500*0.0001)/2500 = approx. 3.91%

- For a $3,000 deposit, the blended APY = (2000*0.0489+1000*0.0001)/3000 = approx. 3.26%

- For a $4,000 deposit, the blended APY = (2000*0.0489+2000*0.0001)/4000 = approx. 2.45%

- For a $5,000 deposit, the blended APY = (2000*0.0489+3000*0.0001)/5000 = approx. 1.96%

- For a $7,000 deposit, the blended APY = (2000*0.0489+5000*0.0001)/7000 = approx. 1.40%

Simple interest calculations for illustration only.