Overview

The banking tools you need

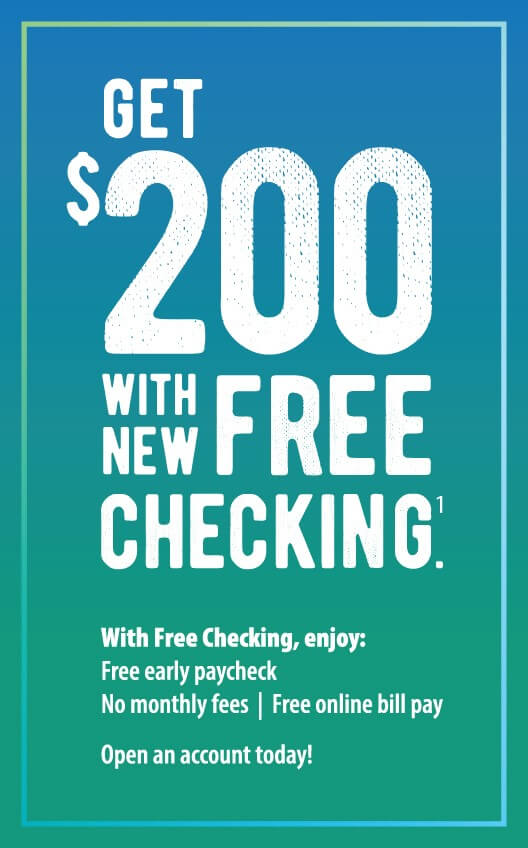

When your needs go beyond a traditional checking account, Debit Card Banking is your modern solution. Not only does this account offer 24/7 account access, it also comes with all the features you need to do your banking at home or on the go.

Become a MIDFLORIDA Credit Union member and open a Debit Card Banking account by visiting a branch.